Create your

happy place.

Discover more with an S&T home equity total line of credit.

3.99% APR1 introductory rate for 6-months

7.24% APR1 current annual percentage rate

SIM Swapping and Mobile Phone Hijacking

Protect your personal information from this emerging fraud risk.

Events Near You

Attend an event happening in or around the communities we serve.

Simple Financial Calculators

Get your finances on track with an easy way to get a handle on your spending and find areas where you can improve your finances.

Explore Our Products & Services

Diversify Savings and Get Higher APYs on Your Terms

Let us Help You Find the Right Account with Merlin

Saving for Your Future

Our savings accounts span every need, from setting aside cash to saving for college or retirement

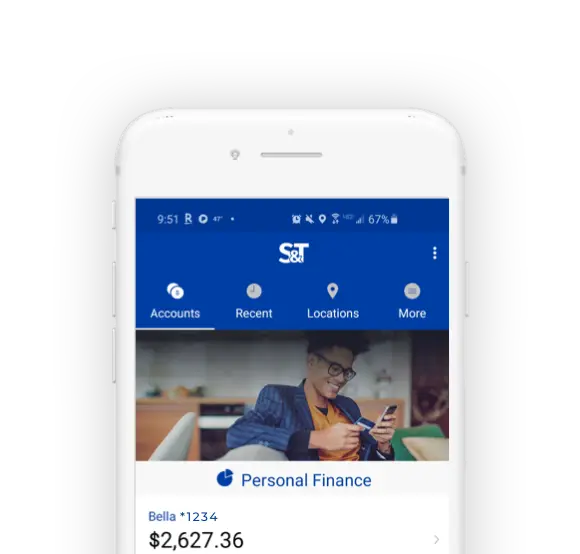

Banking for Wherever You Are

Mobile & Online Banking

Banking, Your Way

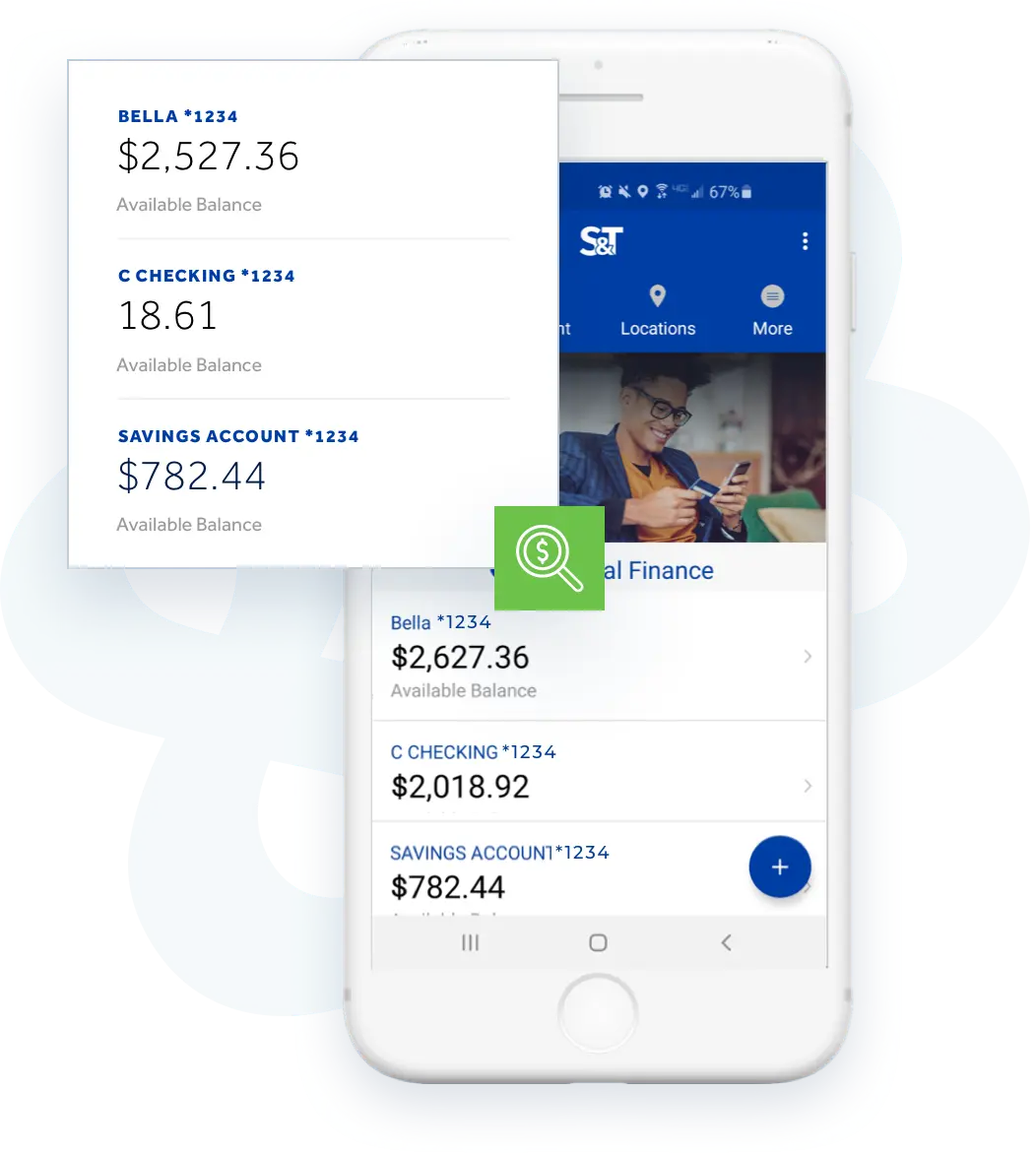

The S&T Bank Mobile App provides all the features of online banking on your mobile device – check balances, pay bills or people, and transfer funds between S&T accounts.

- View a snapshot of account balances

- Transfer funds between S&T accounts

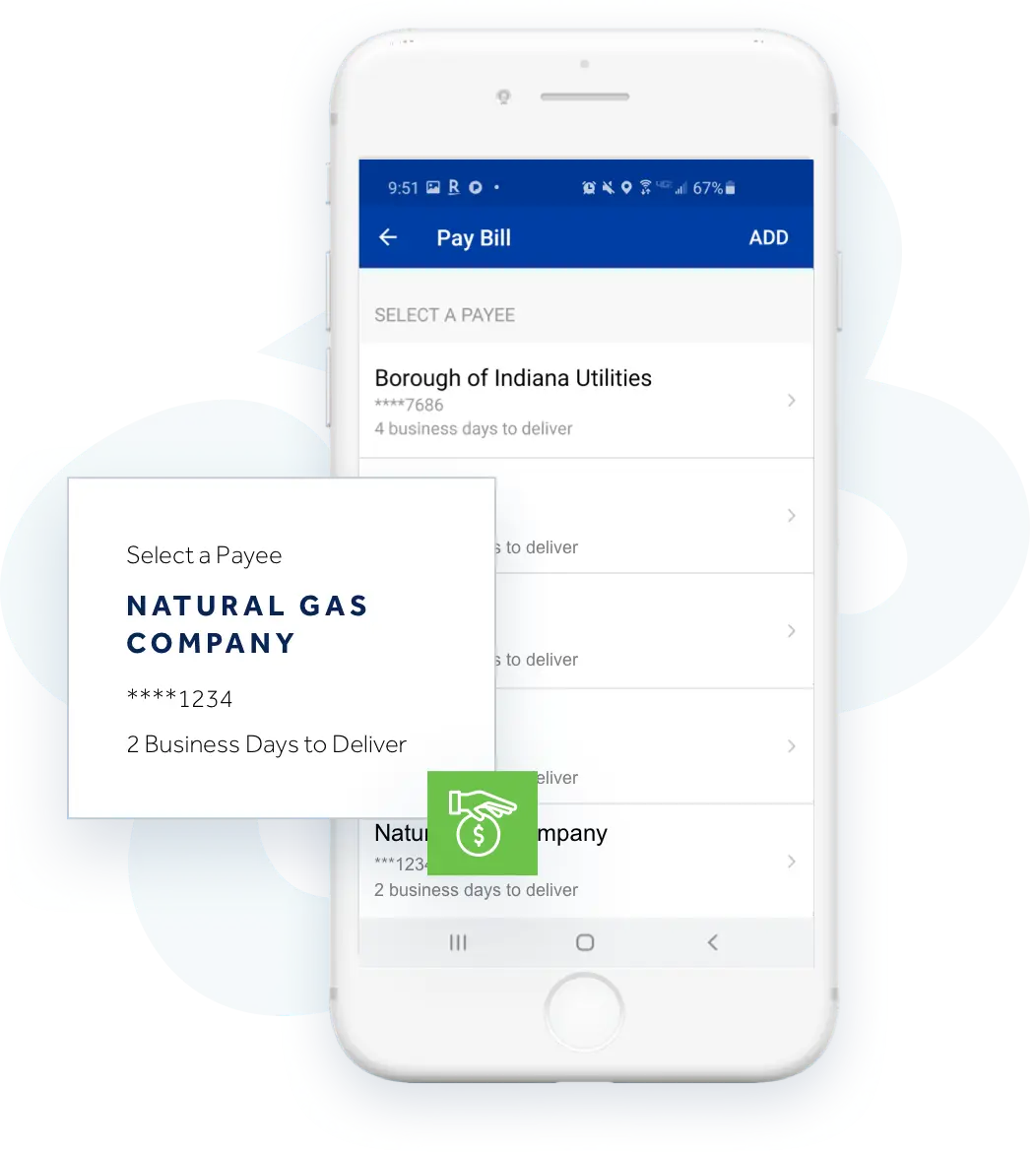

- Pay bills and manage payees

- Deposit checks with Mobile Deposit

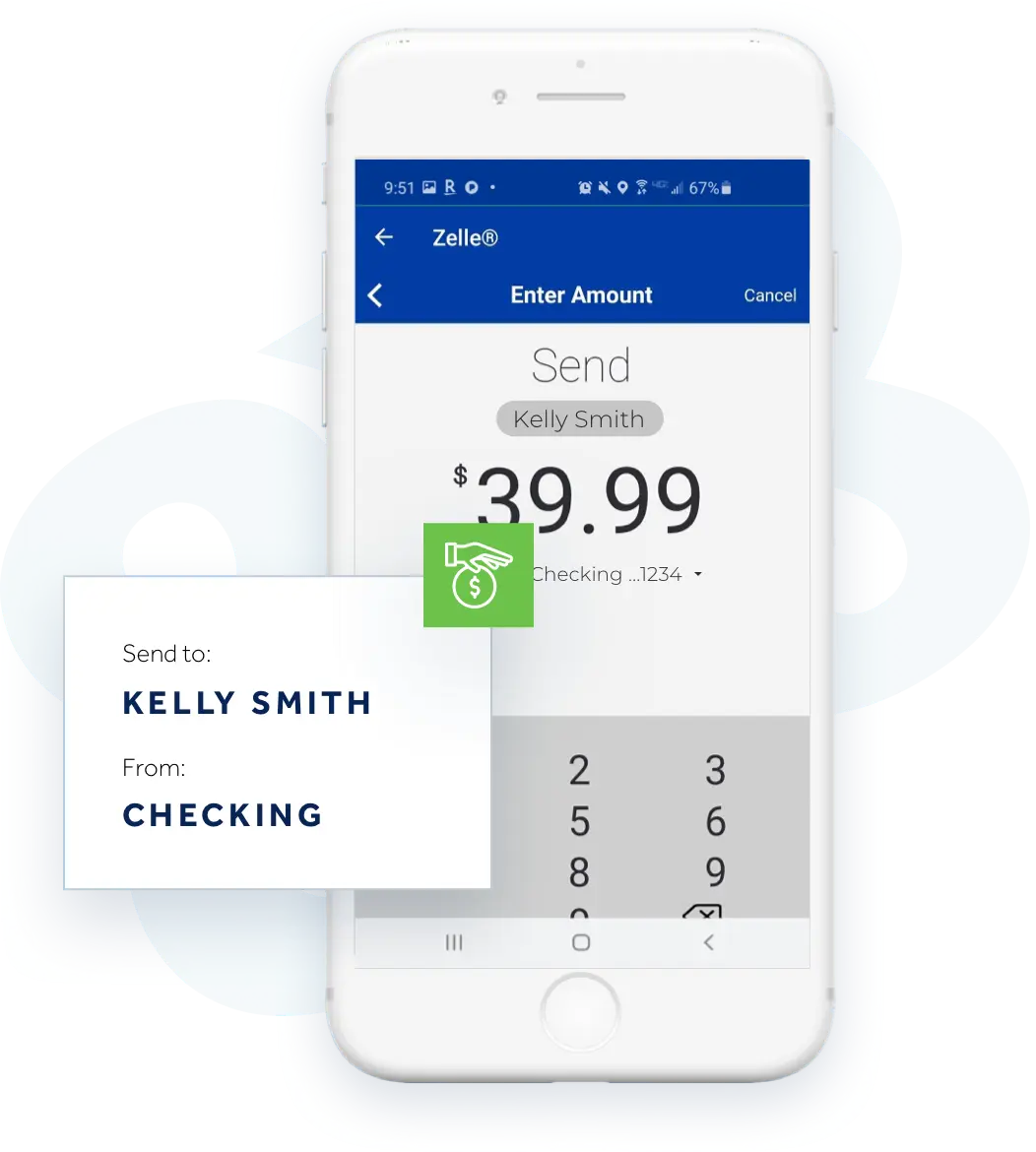

- Pay people with Zelle®

- View and activate My Rewards offers

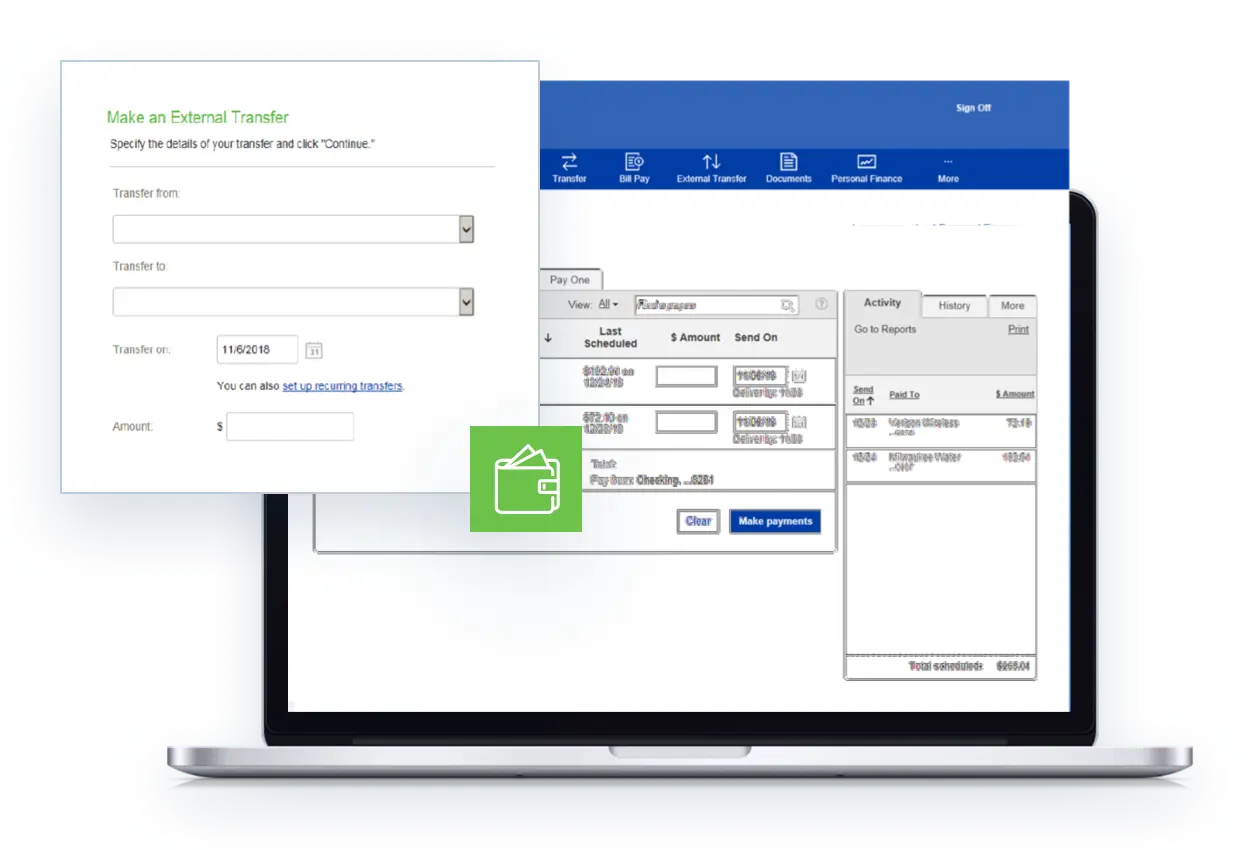

Payments Made Easy

S&T online banking gives you the convenient financial management you expect. Whether it’s secure transactions, simple online bill payments or money transfers, we make sure you money gets safely where it needs to go.

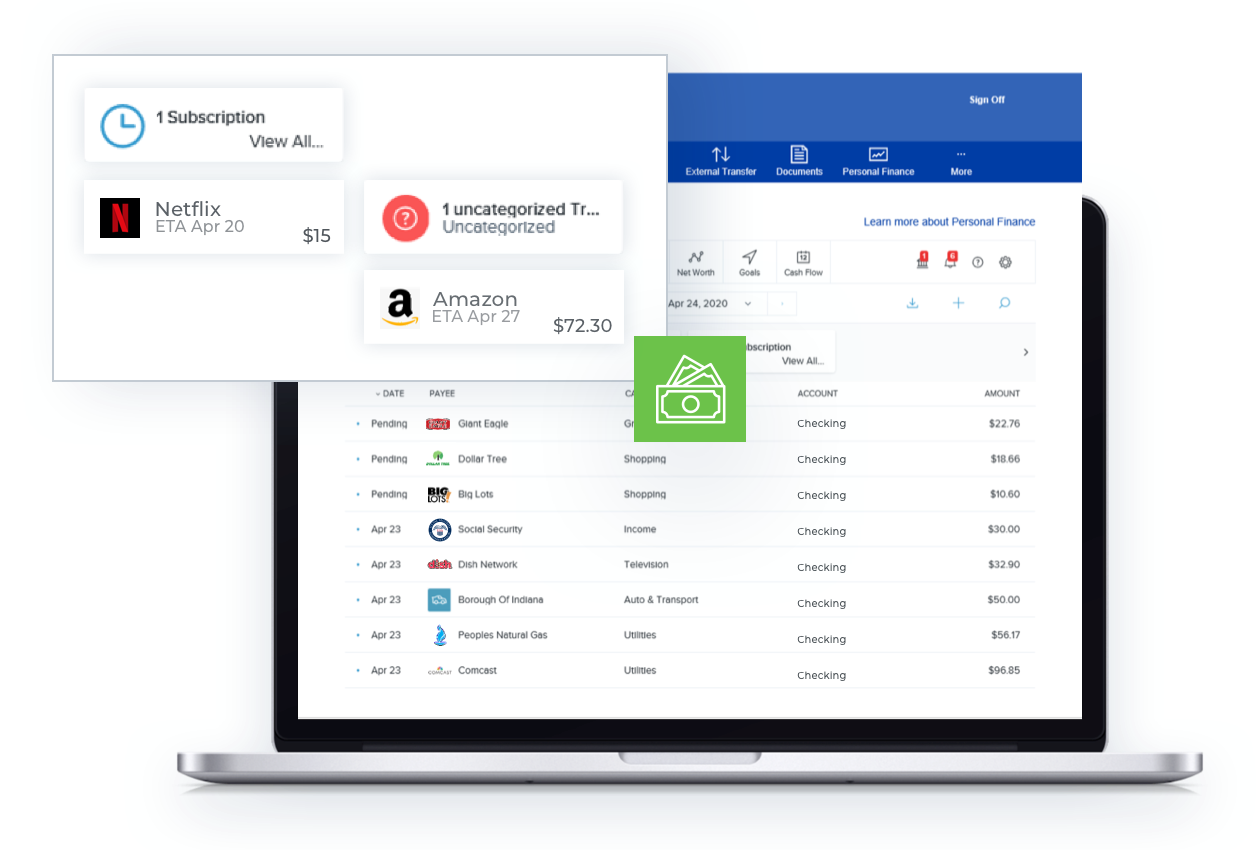

Keep Track of It All

Easily monitor your spending, balances and account activity from wherever you are. Your statements are always available and keep you in control by providing a detailed record of every transaction.

See the Big Picture

S&T offers you an online, streamlined, comprehensive way to manage your finances across accounts and financial institutions. Track, budget, report and organize your finances with our Personal Finance tool. You’ve got this.

Your Digital Wallet

In a hurry? Left your wallet at home? No problem. Pay for everyday purchases quickly and securely when you enable your S&T debit card through Apple Pay, Google Pay, and Samsung Pay. Just tap and go.

Your S&T Debit Card

With your S&T’s debit card, you have 24-hour, secure access to your funds at thousands of ATMs wherever you see Cirrus, NYCE or Visa symbols. Use your debit card to pay online and on the go with ease, convenience and peace of mind.

Banking for Wherever You Are

Pay, transfer, deposit and monitor your accounts with S&T Bank’s Mobile Banking App.

Banking for Wherever You Are

Pay, transfer, deposit and monitor your accounts with S&T Bank’s Mobile Banking App.

FAQs

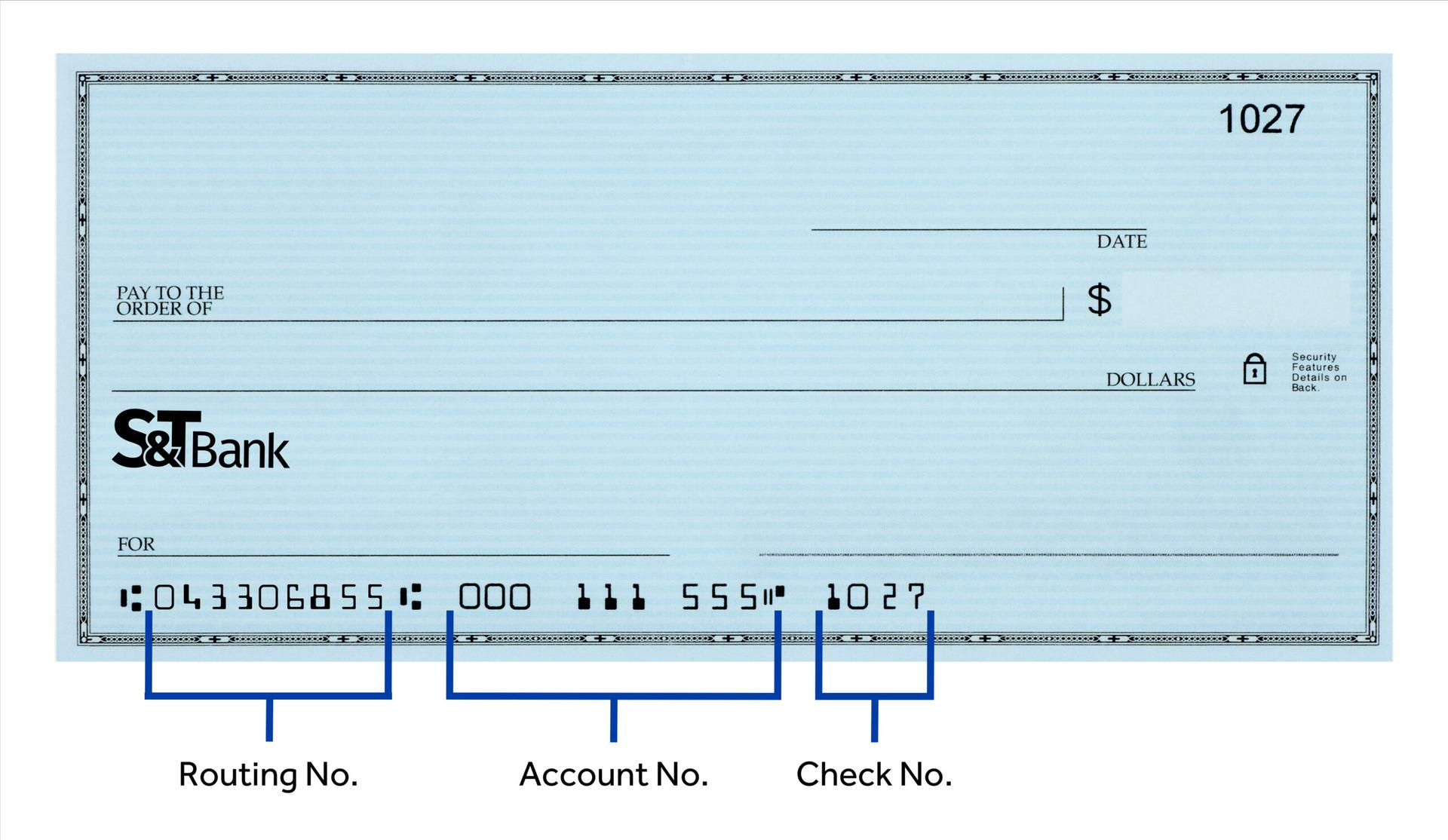

A checking account allows you to make deposits, withdrawals and fund transfers for day-to-day transactions. Money can be deposited into your account at a branch, ATM or using mobile deposit. You can easily utilize checks, debit cards and mobile wallet to make purchases or withdraw funds at an ATM or branch.

A checking account allows you to make deposits, withdrawals and fund transfers for day-to-day transactions. Money can be deposited into your account at a branch, ATM or using mobile deposit. You can easily utilize checks, debit cards and mobile wallet to make purchases or withdraw funds at an ATM or branch.

To open the account, you’ll need:

- Initial funds to deposit

- Driver’s license, state identification or US Passport

- Social Security Number

To open the account, you’ll need:

- Initial funds to deposit

- Driver’s license, state identification or US Passport

- Social Security Number

Reorder your personal checks online directly through Deluxe.

Reorder your personal checks online directly through Deluxe.

Yes, some checking accounts are eligible to earn interest.

Yes, some checking accounts are eligible to earn interest.

Please view the consumer account opening requirements or business account opening requirements to learn about the documents you will need.

Please view the consumer account opening requirements or business account opening requirements to learn about the documents you will need.